How to Get Loans with MTN MoKash and Airtel Money Quick Loan

More from business

- HOW TO SAVE MONEY

- How to Develop a Good Business Model: The Hidden Elements

- 25 Small Business Ideas for Beginners to Start Today

- 10 Best Side Hustle Ideas In Uganda (To Earn an Extra $2,000+ Per Month)

- 21 Low Cost Small Business Ideas You Can Start For High Profit

- How to Make Your Money Work for You 24/7

- Top Reasons Why Ecommerce Businesses Fail in Uganda

- 20 Proven Methods for Making Money Online

- The Ultimate Guide to Dantty Affiliate Marketing Program: How to Earn Commission on Every Sale

- 10 Ugandan Entrepreneurs Who Are Making Big Money

- 10 Tips on how to become a successful entrepreneur in Uganda

- The Importance of Networking for Ugandan Entrepreneurs

- How to Get Loans with MTN MoKash and Airtel Money Quick Loan

- The Benefits of Investing in a Responsive Website for Your Business

- 5 Reasons Why Your Business Needs a Professional Website

Mobile loans are becoming increasingly popular in Uganda, providing a quick and convenient way for people to access credit without the need for collateral or extensive paperwork. Two of the leading mobile loan services in Uganda are MoKash by MTN and Airtel Money by Airtel. In this blog, we will compare these two services and explore how to access loans using each platform.

How to Get Loans with MoKash

MoKash is a service provided by MTN that allows customers to save and borrow money conveniently using their mobile phones. The customer is not required to visit a bank to complete forms.

MoKash provides you with a Loan Limit that you may not exceed. This loan limit is determined by how much money you save in your MoKash account, your repayment behavior when you get MoKash loans, and your usage of Mobile Money and other MTN services.

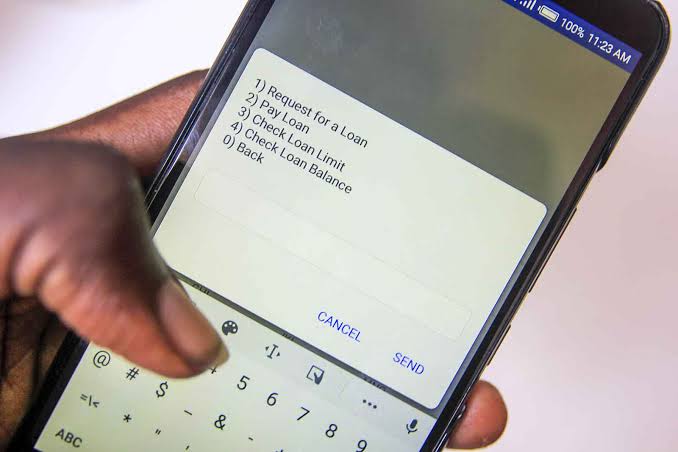

Getting a loan through MoKash:

- Dial *165*5# on your MTN line.

- Select MoKash.

- Select Loans.

- Select Option 1, then go ahead and request a loan.

- Enter the amount you wish to borrow.

- Enter your pin to confirm.

Checking your MoKash loan credit limit:

- Dial *165*5# on your MTN line.

- Select option 1 (MoKash).

- Select option 2 (Loans).

- Select option 3 (to check credit limit).

How to Get Loans with Airtel Money Quick Loan.

If you're in need of some extra cash, Airtel Money quick loans may be a good option to consider. This service allows Airtel Money users to borrow money instantly, without the need for collateral or a lengthy application process. In this blog post, we'll explain how to get a loan from Airtel Money and what you need to know before you borrow.

Step 1: Register for Airtel Money

Before you can get a loan from Airtel Money, you'll need to have an Airtel Money account. If you don't have one already, you can register by dialing *185# on your Airtel line and following the prompts. You'll be asked to provide your personal details and create a 4-digit PIN for your account.

Step 2: Check Your Eligibility

To be eligible for an Airtel Money loan, you need to have a good credit score and transaction history on Airtel Money. The loan amount you can borrow will depend on your credit score and transaction history. You can check your eligibility by dialing *185# and selecting the loans option.

Step 3: Apply for a Loan

Once you've confirmed your eligibility, you can apply for a loan by dialing *185# and selecting the loans option. You'll be asked to enter the loan amount you want to borrow, and then follow the prompts to complete the loan request.

Step 4: Repay the Loan

When your loan request is approved, the loan amount will be credited to your Airtel Money account. You will be charged an interest fee on the loan amount, and will need to repay the loan within the specified repayment period. Be sure to read the terms and conditions carefully before taking out a loan from Airtel Money.

Things to Know Before You Borrow

- Airtel Money loans are subject to interest fees, which vary depending on the loan amount and repayment period.

- You will need to repay the loan within the specified repayment period to avoid late fees and penalties.

- Failure to repay the loan on time may negatively impact your credit score and transaction history on Airtel Money.

- Airtel Money reserves the right to decline loan requests based on your credit score and transaction history.

In brief, Airtel Money loans can be a convenient and accessible way to borrow money quickly.

Getting a loan through Airtel money

- Dial *185# on your Airtel line to access the Airtel Money menu.

- Select option 4 for loans.

- Select option 1 to request a loan.

- Enter the loan amount you want to borrow and follow the prompts to complete the loan request.

- If your loan request is approved, the loan amount will be credited to your Airtel Money account.

Comparing MoKash and Airtel Money

When it comes to mobile money services in Uganda, two major players come to mind: MTN Money and Airtel Money. Both services offer similar features, including the ability to save and borrow money, as well as pay bills and transfer funds. However, there are some key differences between the two services.

Firstly, the loan process is different between the two services. With MoKash, customers need to dial *165*5# and follow the prompts to select loans and request a loan. They then enter the amount they wish to borrow and confirm their pin. With Airtel Money, customers can take a loan while transacting normally on the platform. If they have insufficient funds to complete the transaction, they will get a prompt to take a loan. They can then take loans multiple times until they exhaust their limit and have 15 days to repay.

Another key difference is in the loan limits. MoKash loans range from UGX 1,000 to UGX 1,000,000 with a repayment period of 30 days. However, the loan limit is determined by the amount of savings a customer has accumulated over time. On the other hand, Airtel Money loans range from UGX 1,000 to UGX 1,000,000 with a repayment period of 15 days. Customers can also take out loans based on their transaction history and are notified of their loan limit via SMS.

Both services also have different interest rates and charges. MoKash charges a 9% interest rate on loans, as well as a 5% service fee and 10% withholding tax on each loan. Airtel Money charges a 9% interest rate on loans, as well as a 3.5% service fee and 18% withholding tax on each loan.

In terms of convenience, both services offer easy and quick access to loans and other financial services via mobile phones. However, the loan limits and interest rates may vary based on individual circumstances and preferences.

Overall, while both MoKash and Airtel Money offer similar services, there are some key differences in their loan processes, limits, and fees. Customers should consider their personal needs and preferences before choosing a mobile money service for their financial needs.